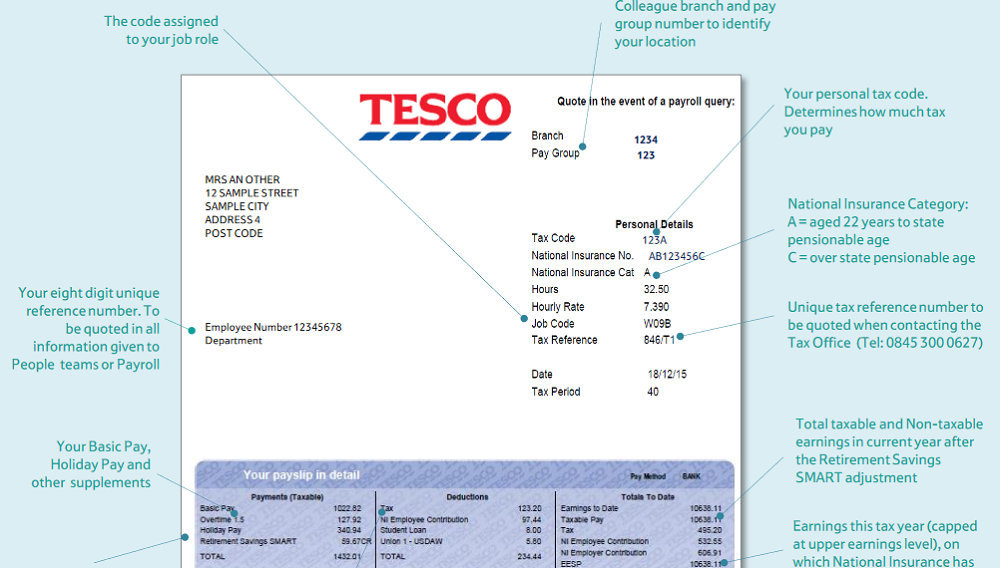

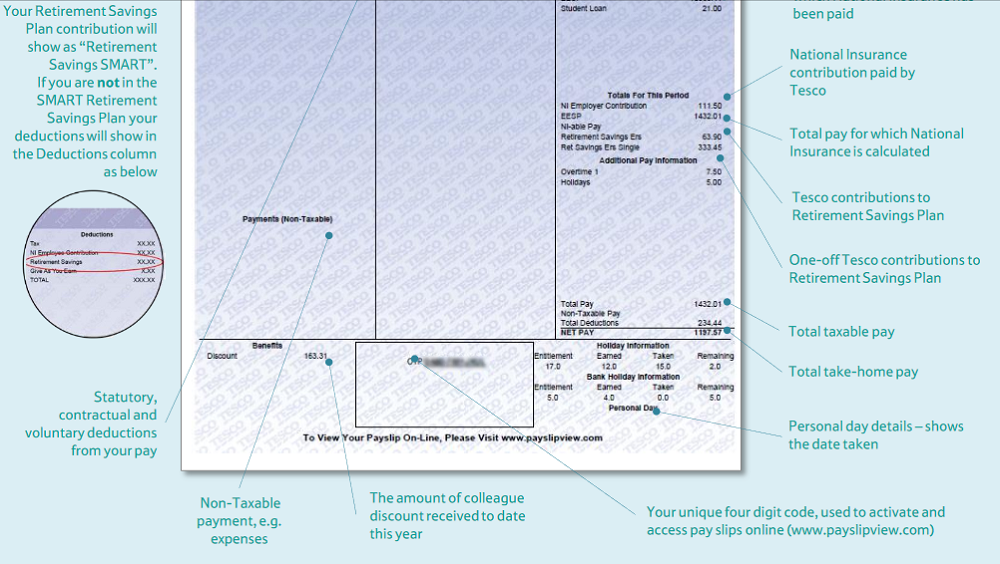

Tesco Payslip Explained.

Here we explain your full Tesco payslip, including how to view overtime pay, your Hourly rate, your average weekly page, premium pay, deductions, holiday pay, Job codes, Occupation codes and taxes.

A complete description and breakdown of your Tesco Payslip.

All Tesco Payslip Details.

| Payslip Details | Detail Explained |

|---|---|

| BASIC HOURS | Your weekly contracted employee hours at Tesco. |

| DEPARTMENT | Department that the staff memeber works in at their place of work. |

| EMPLOYEE NAME | Your employee name |

| EMPLOYEE NUMBER | A unique 8 digit unique reference number. Used with HR or Payroll. |

| HOURLY RATE | Your contracted hourly pay rate at Tesco. |

| HOURS | Weekly contracted hours at Tesco. |

| JOB CODE | The code which has been assigned to your job role. |

| NATIONAL INSURANCE CAT | The rate of National Insurance you contribute, indicated by a letter. |

| NATIONAL INSURANCE NO. | Unique 9 digit code made from 3 letters and 6 numbers., used to record National Insurance contributions as well as credits you have paid or are entitled to. |

| OCCUPATION CODE | The distribution code assigned to your job role. |

| TAX PERIOD | The current tax period or week. |

| TAX CODE | Your personal tax code – This determines your tax rate. |

| TAX REFERENCE | The company reference number, used by the tax office |

| PAYMENT METHOD | Your payment method, bacs,or cheque. |

| DATE | The date of the end of the current tax period/week. |

Tesco Payments Explained.

| PAYMENT DETAIL | PAYSLIP DESCRIPTION |

|---|---|

| ADDITIONAL HOURS + 33% | Paid for all additional hours worked by drivers on consolidated rates of pay within the 7pm – 7am window, excluding Sundays. Also paid to employees whose annual contract is less than 36/36.5 hours for all additional hours within the 7pm – 7am window, excluding Sunday. |

| ADDITIONAL HOURS X 1 | Paid for all additional hours worked by drivers on consolidated rates of pay. 0.5 paid for hours worked on an off/leisure day e.g. 7.50 hour shift x 0.5 = 3.75 x 1.Paid to employees whose annual contract is less than 36/36.5 hours per week or 1670/1693 per annum (part-timers). |

| ADOPTION PAY | Paid to employees who are entitled to adoption leave. |

| ADVANCE PAYMENT | Payment which supports employees who may change from weekly to 4 weekly pay. Type of loan which has to be repaid. |

| ANTI SOCIAL PREMIUM | Paid at a fixed cash value and not a percentage for all hours worked between 0600 and 0800, or part thereof based on 15min segments. |

| ARREARS NON-PENSIONABLE | Payment made to an employee who has not received the correct pay after a change of role or transfer etc. No pension can be deducted from this payment. |

| ARREARS PENSIONABLE | Payment made to an employee who has not received the correct pay after a change of role or transfer etc. Pension can be deducted from this payment. |

| AVERAGE WEEKLY PAY | The amount of pay used to calculate an employees basic weekly wage. (Distribution) |

| BANK HOLIDAY DAY OT | Paid to employees who work a bank holiday as overtime. |

| BANK HOLIDAY NIGHT OT | Paid to employees who work a bank holiday night shift as overtime. |

| BANK HOLIDAY OVERTIME 1 | Paid for rostered hours on a bank holiday. |

| BANK HOLIDAY OVERTIME 2 | Paid for non-rostered and overtime hours worked on a bank holiday. |

| BANK HOLIDAY PAY | Paid to employees who is contracted to work a bank holiday. |

| BANK HOLIDAY SHIFT PREM1 | Shift premium paid on a bank holiday. |

| BASIC 1.5 | If the Rostered shift starts within a Saturday (0600 Saturday – 0559 Sunday) then this shift will attract a 50% hourly rate increase which will show as a separate amount called BAS15. |

| BASIC 1.5 + SHIFT PREM1 | Basic Shift Premium 1(BASSP1) would increase from 15% to 22.5% of hourly rate would become Basic Shift Premium 1 @ 1.5 (BAS15SP1) |

| BASIC 1.5 + SHIFT PREM2 | Basic Shift Premium 2 (BASSP2)would increase from 20% to 30% of hourly rate would become Basic Shift Premium 2 @ 1.5 (BAS15SP2) |

| BASIC 2 | If the Rostered shift starts within a Sunday (0600 Sunday – 0559 Monday) then this shift will attract a 100% hourly rate increase which will show as a separate amount called BAS20 |

| BASIC 2 + SHIFT PREM1 | Basic Shift Premium 1 (BASSP1) increase from 15% to 30% of hourly rate to become Basic Shift Premium 1 @ 2.0 (BAS2SP1) |

| BASIC 2 + SHIFT PREM2 | Basic Shift Premium 2 (BASSP2) increase from 20% to 40% of hourly rate to become Basic Shift Premium 2 @ 2.0 (BAS2SP2) |

| BASIC PAY | The payment you receive for doing a particular job. Hourly rate x Hours per week. |

| BASIC PENSION | The gross amount of pension paid to pensioners. |

| BASIC SHIFT PREMIUM 1 | Paid as a percentage of the hourly rate. The base rostered shift must pass the premium threshold. In this event the premium will apply to all hours worked on that shift. The premium is 15% of the hourly rate. |

| BASIC SHIFT PREMIUM 2 | Similar to the rules for Basic Shift Premium 1 but if the rostered shift were to break both premium thresholds, the higher premium rate will be paid. The Premium is paid at 20% of the hourly rate. |

| BONUS | Paid to certain groups of employees relating to the productivity within the working environment. |

| CALL OUT | Paid to compensate employees having to attend work outside their normal hours. |

| CARE 4 | Salary Sacrifice that enables employees to purchase vouchers for the Child care benefit scheme. |

| CASHIER PAYMENT | Payment for employees who don’t normally work on the checkouts, however during busy periods are required to do so. Has since been replaced by relief pay. |

| CHRISTMAS BONUS | Paid to certain groups of employees relating to the productivity within the working environment over the Christmas period. |

| COMPANY CAR | Payment made to employee either instead of having a Company Car, or to make up the value of a car selected at a lesser rate. |

| COMPANY SICK PAY | Paid by the company to employees who qualify for company sick pay, when absent due to sickness. Based on an employees entitlement, which is dependant on their length of service with the company. |

| CONTINUITY PAY | Payment made as a result of continuous attendance. |

| CONTRACTUAL OVERTIME | Paid to non-annual hours population whose contractual hours exceed 36/36.5 hours. |

| DEPUTISING PAY | Paid to employees who deputise to a higher graded job. |

| DEVELOPMENT RATE | Payment used to support employees who move into a higher grade role as part of a development. |

| DISTURBANCE ALLOWANCE | Payment for employees who relocate. Support for furnishings i.e. carpets, furniture etc. |

| DRIVER ALLOWANCE | Allowance paid to Tesco drivers. (Distribution) |

| DUTY MANAGER PAYMENT | Payment made to a manager who has been the acting duty manager on a certain day. |

| DIRECTOR MEALS | Directors meal payment. |

| DTEC ALLOWANCE | DTEC allowance payment. |

| EMPLOYEES REBATE PAID | A rebate on employees National Insurance. |

| ENTERTAINING OVERSEAS | Non-taxable payment used to pay an employees entertainment expenses. Expats. |

| ENTERTAINING STAFF | Non-taxable payment used to pay for entertaining staff / expenses. |

| ENTERTAINING UK | Non-taxable payment used to pay an employees entertainment expenses. |

| EX-GRATIA TAXABLE | Paid to employees who have been made redundant based on length of service. Only amounts over £30,000. |

| EX-GRATIA 1 TAXABLE | Paid to employees who have been made redundant based on length of service. Only amounts over £30,000. |

| EX-GRATIA 2 TAXABLE | Paid to employees when their employment is terminated other than redundancy. Taxable. |

| EX-GRATIA PAY 1 | Paid to employees who have been made redundant based on length of service. |

| EX-GRATIA PAY 2 | Paid to employees when their employment is terminated other than redundancy. Non-taxable. |

| EX-GRATIA PAYMENT | Paid to employees who have been made redundant based on length of service. |

| EXPENSES NTAX REVERSAL | Reversal of expenses. |

| EXPENSES TAXABLE | Taxable payment that is used to pay an employees expenses. |

| EXPRESS BONUS | Performance related payment. Express sites only. |

| FIRST AID | Paid to specific employees who has trained in basic first aid and received a valid certificate. |

| FROZEN AMOUNT | Paid to Composite employees who work in the freezer chamber for the main part of their shift. |

| HCI REDUCTION | Salary sacrifice that allows an employee to purchase a PC for personal use. Only one scheme was ever launched in 2006. |

| HOL/BANK HOL LEAVER PAY | Paid to employees, if they leave the company and have not taken their full entitlement. |

| HOL/BANK HOL1 LEAVER PAY | Paid to employees, if they leave the company and have not taken their full entitlement. |

| HOL/BANK HOL2 LEAVER PAY | Pay to employees who leave and are in the accrued holiday scheme. (Employee must have hols remaining). |

| HOLIDAY PAY | Payment made at P60 or basic rate (whichever is the greater) during times of annual leave. |

| HOTEL | Non-taxable payment used to pay an employees hotel expenses. |

| MINUS HOURS | Shows the monetary amount of the minus hrs for the pay period. |

| JURY SERVICE | Deducted from Tesco employees who are on Jury Service. Deduction is made on receipt of invoice from the court. |

| KEY HOLDER | Payment to employees who are authorised to access a site out of hours. i.e. if the store alarm has been set off. |

| LAUNDRY | Paid to employees who are required to launder their Company provided uniform. |

| LOCATION PAY | Payment made to employees situated at stores where the cost of living is higher than the normal average. |

| LOCUM 2 – SAT BEFORE 7PM | Payment for employees on locum payroll only. Rate 2 paid to employees who work Saturday before 7pm. |

| LOCUM 4 – SUNDAY & BH | Payment for employees on locum payroll only. Rate 4 paid to employees who work Sunday and Bank holidays. |

| LOCUM MON-FRI BEFORE 7PM | Payment for employees on locum payroll only. Rate 1 paid to employees who work Mon – Fri before 7pm. |

| LOCUM3 MON-FRI AFTER 7PM | Payment for employees on locum payroll only. Rate 3 paid to employees who work Mon – Fri after 7pm. |

| MARKET SUPPLEMENT | Payment made to employees to aid recruitment, such as bakers and butchers. |

| MATERNITY PAY | Enhanced (company) maternity pay. |

| MEALS | Non-taxable payment used to pay an employees meals expenses. |

| MOBILE LINE RENTAL | Non-taxable payment used to pay an employees line rental expenses. |

| MOBILE PHONE | Non-taxable payment used to pay an employees mobile phone expenses. |

| MORTGAGE EQUALISATION | Paid to employees who have moved to fulfil a company requirement and purchased a higher valued house. |

| NATIONAL INSURANCE REB | Rebate for National Insurance contributions. |

| NI EMPLOYEES REBATE | Rebate of National Insurance contributions. |

| NIGHT OVERTIME 1 | Paid to part time staff that work additional hours up to 36.5 per week. The extra hours must be worked between 10pm and 6am. |

| NIGHT OVERTIME 1.5 | This is paid to staff that work in excess of 36.50 hours in a week. These hours must be worked between 10.00pm and 6.00am. The Premium rate paid is dependent upon length of service. |

| NIGHT OVERTIME 2 | This is paid to staff working in excess of 36.50 hours in a week, between Midnight Saturday to 6.00am Sunday and 8.00pm Sunday to Midnight. It also applies to Bank Holidays between the hours 10.00pm and 6.00am. |

| NIGHT PREM 00.00 – 06.00 | Paid to employees who work between the hours of 12am and 6am. |

| NIGHT PREM 22.00 – 00.00 | Paid to employees who work between the hours of 10pm and 12am. |

| NIGHT PREMIUM | Premium paid to employees who work the night shift. |

| NIGHT SUNDAY OVERTIME | Paid to full time non-annual hours population for hours worked over the normal scheduled shift, within the following windows on a Sunday. 12am-7am and 7pm-11.59pm. |

| NON-TAXABLE PROFIT SHARE | Payment made when an employee has decided to sell their free shares, non taxable. |

| ON CALL | Paid to employees who have may need to attend work outside their normal working hours. |

| OVER SEAS ALLOW NTAXABLE | Non-taxable allowance that is paid to employees who are working overseas. |

| OVER SEAS ALLOW TAXABLE | Taxable allowance that is paid to employees who are working overseas. |

| OVERTIME 1 | This payment is paid to any part-time employees who work any extra hrs up to 36.5 hrs total in a week. |

| OVERTIME 1 + PREMIUM 33% | Paid for all additional hours worked by drivers on consolidated rates of pay within the 7pm 7am window, excluding Sundays. Also paid to employees whose annual contract is less than 36/36.5 hours for all additional hours within the 7pm – 7am window, excluding Sunday. |

| OVERTIME 1.25 | Time plus a quarter will be used for any full shift overtime (> than 4 hours) assuming that the employee has completed their 37.50 basic hours. |

| OVERTIME 1.5 | This payment is paid to any employee who works in excess of 36.5 hrs per week. Rate depends on the employees start date. When additional hours are worked either before and after a rostered shift or a non rostered day, these hours would be paid at the overtime rate. Monday 0600 to Sunday 0559 – Time and Half of hourly rate (150%). |

| OVERTIME 1.5 +PREMIUM 33% | Paid to full time employees for hours worked over the normal shift within the 7pm – 7am window. Also paid to part time employees, when they have completed a full time week. Hours worked paid at hourly rate x 1.5 plus number of hours work divided by 3 x hourly rate. |

| OVERTIME 1.5 +SHIFT PREM1 | When overtime is worked before shift or after shift, the appropriate premium is also subject to the same rate increase. Monday 0600 to Sunday 0559. Basic Shift Premium 1 (BASSP1) would become Overtime Shift Premium 1 @ 1.5 and paid at 22.5% (OT15SP1). |

| OVERTIME 1.5 +SHIFT PREM2 | When overtime is worked before shift or after shift, the appropriate premium is also subject to the same rate increase. Monday 0600 to Sunday 0559. Basic Shift Premium 2 (BASSP2) would become Overtime Shift Premium 2 @ 1.5 and paid at 30% (OT15SP2). |

| OVERTIME 2 | This is paid to employees who work a bank holiday or a Sunday shift as overtime. When additional hours are worked either before and after a rostered shift or a non rostered day, these hours would be paid at the overtime rate. Sunday 0600 to 0559 Monday – Double Time of hourly rate (200%). |

| OVERTIME 2 + PREMIUM 33% | Paid to full time employees for hours worked over the normal shift within the following window – 12am – 7am / 7pm – 11:59pm. Hours worked paid at hourly rate x 2 plus hours worked divided by 3 x hourly rate. |

| OVERTIME 2 + SHIFT PREM1 | When overtime is worked before shift or after shift, the appropriate premium is also subject to the same rate increase. Sunday 0600 to Monday 0559. Basic Shift Premium 1 (BASSP1) would become Overtime Shift Premium 1 @ 2.0 and paid at 30% (OT2SP1). |

| OVERTIME 2 + SHIFT PREM2 | When overtime is worked before shift or after shift, the appropriate premium is also subject to the same rate increase. Sunday 0600 to Monday 0559. Basic Shift Premium 2 (BASSP2) would become Overtime Shift Premium 2 @ 2.0 and paid at 40% (OT2SP2). |

| OTHERS | If there is no room on the payslip because the employee has been paid so many elements the remaining elements will be grouped together and paid as others. |

| PATERNITY PAY | Paid absence to enable employees to spend 2 weeks with his/her family at the time his/her spouse/partner has given birth, providing the employee has 26 weeks continuous service at the date of birth. |

| PAY ADJUSTMENT | Payment made to employees if their pay needs to be adjusted in anyway. |

| PAY IN LIEU 1 | Paid in redundancy, in lieu of notice. It is free of deductions if the total is less than £30,000. |

| PAY IN LIEU 1 TAXABLE | Taxable amount used only in a redundancy situation. When an employee does not work their notice. |

| PAY IN LIEU 2 | For other than redundancy. As above. |

| PAY IN LIEU 2 TAXABLE | Paid in dismissal and compromise leavers for amounts exceeding £30,000. |

| PENSION ARREARS | The backdated pension pay paid in the form of arrears. |

| PERSONAL RATE | Is a payment which makes up the difference in pay if an employees role is to be made redundant and alternative lower paid position is offered. The rate cannot exceed 25% of the new wage. |

| PETROL | Non-taxable payment used to pay an employees petrol expenses. |

| PHONE | Non-taxable payment used to pay an employees phone expenses. |

| POST TAX PAYMENT | Payment that can be made without any deductions being deducted. |

| PRE TAX NON PENSIONABLE | One-off payments that are taxable and non-pensionable. |

| PRE TAX ADJUSTMENT | Payment adjustment that can be made before tax is deducted to repay monies lost or to pay one off taxable payments. |

| PRE TAX PAYMENT | Payment that can be made before tax is deducted to repay monies lost or to pay one off taxable payments. |

| PRE TAX PENSION | One-off payments that are taxable and pensionable. |

| PROTECTED ELEMENT | Payment made to employees who have had salaries reduced due to job re-evaluation. |

| PROTECTED RATE | Paid to employees to cater for adversely affected minimum weekly payments, whenever shifts are amended. |

| QUALITY BONUS | Paid to employees where applicable covered by the respective local agreements. |

| RELIEF PAY | Payment for employees who don’t normally work on the checkouts, however during busy periods are required to do so. |

| RESTAURANT SUBSIDY | A payment made towards the cost of meals for employees who do not have access to a staff restaurant. |

| RETAINED PAY | Payment that is made if there is a change in the shift premium. The payment is the difference between the old shift premium and the new shift premium and or to protect the downgrade in a location allowance. |

| RETIREMENT PAY | This is paid to employees who are approaching retirement (6 months before). The employee can reduce their hours by a 5th of their working week and still get paid the same weekly wage. |

| SATURDAY PAYMENT | Payment made if an employee works a Saturday shift. |

| SATURDAY PREMIUM | Paid to staff, who are contracted to work at least 36hrs per week part of which must be worked on a Saturday. |

| SATURDAY WORK | Paid to employees who work a Saturday shift. |

| SHARE INCENTIVE PLAN | Payment made when an employee has decided to sell their free shares, and they need to be taxed an Ni’d. |

| SHIFT 15% | Shift premium @ 15% of your hourly rate. |

| SHIFT 20% | Shift premium @ 20% of your hourly rate. |

| SHIFT CHANGE PREMIUM | Applicable to any member of staff changing at the Management’s request to day, night or afternoon shift during the week in which they would normally have expected to complete a full week on any of the specified shifts. |

| SHIFT PREMIUM | Paid to employees who work between the hours of 10pm and 6am. |

| SHIFT PREMIUM 1 | Paid to employees who work between the hours of 10pm and 6am. |

| SHIFT PREMIUM 2 | Paid to employees who work between the hours of 10pm and 6am. Percentage of the annual salary. (exec only) |

| SMART FINAL SALARY PEN | Tesco pension scheme (salary sacrifice) for full time employees up until April 2001. |

| SMART PENSION BUILDER | Tesco pension scheme (salary sacrifice) for all employees regardless of hours from April 2001. |

| SMART PENSION REFUND | Refund paid to an employee who has opted out of the pension scheme or is leaving the company. Employee must have been in the pension scheme for less than 2 years to receive the refund. |

| SMART PENSION SAP | Top up payment made to an employee who is entitled to statutory adoption pay and has been disadvantaged by participating in the Smart Salary Sacrifice Pension Scheme. |

| SMART PENSION SMP | Top up payment made to an employee who is entitled to statutory maternity pay and has been disadvantaged by participating in the Smart Salary Sacrifice Pension Scheme. |

| STATE BENEFIT | Negative Payment to reclaim benefits that have already been paid. |

| STATUTORY ADOPTION PAY | Statutory payment paid to employees who are entitled to adoption leave. Must have worked for the company continuously for 26 weeks and earn over the lower earnings limit. |

| STATUTORY MATERNITY PAY | Statutory Maternity pay is a payment made to female employees who are pregnant. As they will require time off, the government pays them a weekly payment that is dependant on their earnings previously. SMP is paid for a maximum of 39 weeks. |

| STATUTORY PATERNITY PAY | Statutory payment paid to employees who are entitled to paternity leave. Must have worked for the company continuously for 26 weeks. |

| STATUTORY REDUNDANCY | Statutory payment made if an employee is made redundant. |

| STATUTORY SICK PAY | Statutory payment made to all entitled employees who are absent due to sickness. |

| SUNDAY OVERTIME | This is paid to employees who work a bank holiday or a Sunday shift as overtime. |

| SUNDAY PAYMENT | Payment made if an employee works a Sunday shift. |

| SUNDAY PREMIUM | Paid to employees who work on a Sunday. |

| SUNDAY WORK | Paid to employees who work on a Sunday. |

| SUNDRY | Non-taxable payment used to pay an employees sundry expenses. |

| TAX CREDIT | Paid on behalf of Government Agencies. |

| TAXABLE PROFIT SHARE | Payment made when an employee has decided to sell their free shares, and they need to be taxed an Ni’d. |

| TIME CHANGE PREMIUM | Applicable for changes in shift start times, where an employee is requested by Management to change shift start times at short notice. Here, an inconvenience/disruption supplementary payment will be made at basic hourly rate x actual differential hours involved (minimum one hour payment guaranteed). |

| TRAINER PAY | Paid to individuals who have been asked to train employees. |

| TRAVEL | Non-taxable payment used to pay an employees travel expenses. |

| TRIV PEN PAY FS NTAXABLE | One off payment. A pension payment which is not taxable. |

| TRIV PEN PAY FS TAXABLE | One off payment. A pension payment which is taxable. |

| TRIV PEN PAY PB NTAXABLE | One off payment money purchase. A pension payment which is not taxable. |

| TRIV PEN PAY PB TAXABLE | One off payment money purchase. A pension payment which is taxable. |

| UN-SOC HRS PREM 100% | Paid for all hours worked between midnight Saturday and midnight Sunday. Paid at basic hourly rate x 100%. |

| UN-SOC HRS PREM 20% | Paid for all hours worked between 7am-7pm on a Saturday. Paid at basic hourly rate x 20%. |

| UN-SOC HRS PREM 33% | Paid for all hours worked between 7pm-7am, Sunday to Saturday. Paid at basic hourly rate divided by 3. |

| UNSOCIABLE HOURS | Paid to employees who work unsociable hours i.e. Night shift. |

| VAT EXPENSES | Non-taxable payment used for employees who had to make a VAT payment/expenses. |

| WAGE SUPPLEMENT | Payment is made in all manner of situations, where existing elements of pay are deemed not suitable for the additional payments. |

| WEEKEND OVERTIME | Payment made if an employee works a weekend shifts overtime. |

| WEEKEND PREMIUM | Payment made if an employee works a weekend shifts. |

| TOTAL | Total amount of payments this period. |

| Y2K – PAY | Year 2000 payment (millennium). |

I just want to see my payslips and it’s not happening I’ve been two hours trying to do this and I’m giving up – not happy

I’m trying to see my payslips

My complaint: Payslips are not in detail enough, you cant see individual overtime so don’t know if your paid correctly.

cannot see the May 2021 payslip

I can log in but there is no P60

Where has it gone? April 2019 was there yesterday and I am looking for April 2020

Kind regards

Verity Panter

I have had problem with login to my apyslips account diuring long time, what mean that I have not a lots documents from previurs years. My question is, Haw I can take documents from previour years from your system?

Today I printed payslips from October 2020 to October 2021.

I am looking foward for your answer I thank you for any your support.

If you would like to know from what time was tis trobule I have letters from you and my emploeer would have that information also.

Kind Regards

Danuta Piwowarczyk

It used to be easy to see my payslip. Now I’ve managed to find it once, but was so difficult compared to what it used to be and I can’t remember how I did it. IF IT AIN’T BROKE, DON’T FIX IT.